No products in the cart.

Before you can rating a home loan to order a home when you look at the Ireland you may need in initial deposit. Here’s how they work and just how much you will need to have spared.

What is a home loan deposit?

All the loan providers require home financing put after you buy a domestic property during the Ireland. It covers lenders for individuals who fall behind on your money, and you will decreases their threat of credit.

The higher their put, this new reduced you have got to use to cover the cost of your home and you may a decreased financing in order to value (LTV) can often help you support the best interest levels.

Just how much deposit do you want to own a mortgage?

It’s an amount of the home worth, therefore the put amount hinges on the cost of new possessions we wish to pick.

- 10% when you find yourself purchasing your first domestic

- 10% if you’ve owned a property before

- 30% while to find property so you can book

How big is their put and you may LTV will also impact the product sales by which you might be qualified. A tiny put get limitation just how many choice you have got when you look to possess a mortgage.

Having a much bigger put, a home loan is far more reasonable. You can access the cheapest home loan cost in the industry and get the very best sale.

Within the , the loan credit rules changed. First-go out customers can now borrow 4 times its money, and next-go out buyers now you need in initial deposit of 10%.

What does LTV mean?

LTV stands for loan to value, which means how the loan’s size compares to new property’s complete worth. Anytime the house we want to purchase will cost you 3 hundred,000 and you ought to obtain 250,000, you’ll have an LTV out of 83%.

That have a keen LTV away from less than sixty%, you will likely get the very best selection of home loan product sales and the reasonable interest levels.

Illustration of LTV

Case in point away from how your deposit influences the LTV and the pace you’re offered. You ought to relocate to a more impressive possessions and plan to get a house you to will cost you 350,000. Their put are 75,000 (21% of the house worthy of).

How big the deposit means you will want to acquire 275,000, therefore you can be eligible for home loan items that wanted an enthusiastic LTV out-of 80%.

Preserving for in initial deposit

Because there is no body best way to store up to possess a home loan deposit, several things can help you to help you rate some thing upwards tend to be:

- Downsizing otherwise moving in which have family relations otherwise nearest and dearest to save cash to the rent

- Modifying your family members bills like your time or broadband to reduce costs

- Setting up a condition order every month to gain access to new habit of saving

- Evaluating your borrowing, to ensure it is not charging more than it must

- Reviewing your deals to check on these are generally making to it can

- Switching your own expenses designs elizabeth.g. fewer takeaways and products away

Additionally, it is worth taking into consideration setting a goal. Figure out how far you really need to save your self monthly to help you struck your target and stay with it.

How long does it try save to have a deposit?

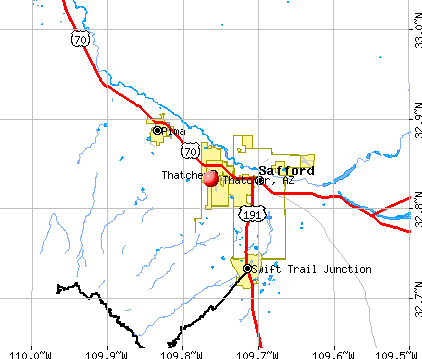

‘s Cost Index reveals the least expensive portion getting shared people and only consumers based on how a lot of time it could decide to try cut to own in initial deposit in for every single RPPI part.

Advice about their home loan deposit

Rescuing a mortgage deposit takes very long, but you will find several getting help towards the costs.

Very first Household Scheme (FHS)

Brand new FHS was created to make up any shortfall involving the domestic rate and you can what you can afford to pay which have a good deposit and you may mortgage.

It’s a shared security scheme one to will pay doing 29% in your home rates in exchange https://paydayloanalabama.com/snead/ for a stake in your possessions. You should buy right back the latest express whenever you can afford to, but you are under no duty to take action.

When you are a first-time buyer to invest in a new build household within the Ireland, you could qualify for the help to order incentive.

Yet not, the value of the strategy might have been briefly risen up to a restriction out-of 31,000 or 10% of the price of the property, any sort of is the cheaper, until .

You can find out more and more the support to purchase added bonus and how to pertain to your Owners Guidance web site.

Assistance from your loved ones

When you’re taking money from a family member towards your put you will need a page confirming it’s something special regarding individual providing the money. So it letter might be signed you need to include:

Additionally, it is well worth checking in the event that you’ll find one tax ramifications, given that large gift ideas may potentially slide during the extent out of gift ideas and you may inheritance tax.

Second methods

Once you’ve your deposit saved therefore understand how much you can obtain, you can consider applying for a home loan. Read our Done Help guide to Mortgage loans to learn more in the using and securing an offer.

Whenever is it necessary to afford the put?

You usually need certainly to transfer the fresh deposit money after finalizing your deals. Up to now you have legally wanted to find the possessions and you may have been in the whole process of completing the acquisition.