No products in the cart.

This transparency can reduce disputes and foster trust between businesses and their suppliers. Additionally, blockchain can streamline the verification process, making it easier to authenticate returned goods and process refunds or replacements promptly. Understanding the nuances of purchase returns helps businesses minimize losses and streamline processes. This article delves into various types of purchase returns, their accounting implications, and best practices for integrating technology in return management. A buyer debits Cash in Bank if a purchase return or allowance involves a refund of a payment that the buyer has already made to a seller.

Format of Purchase Returns and Allowances Journal

- By nature, this account is a contra revenue account, and its balance is deducted from sales revenue when the income statement is drawn.

- Items returned can be damaged or unsellable per company policy, or they returns and allowances account is a ledger account that tracks all returns, discounts, allowances, price adjustments, etc.

- AI-powered analytics can predict return patterns, helping businesses anticipate and prepare for returns more effectively.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- When companies purchase goods from suppliers, they may also offer a purchase returns policy.

Each return should be accompanied by a return authorization form, detailing the reason for the return, the condition of the returned goods, and any actions taken, such as refunds or replacements. This documentation not only supports the accounting entries but also provides a clear audit trail, which is essential for internal controls and external audits. Moreover, maintaining detailed records of purchase returns can aid in analyzing return patterns, helping businesses identify recurring issues and implement corrective measures.

The basics of sales returns and allowances

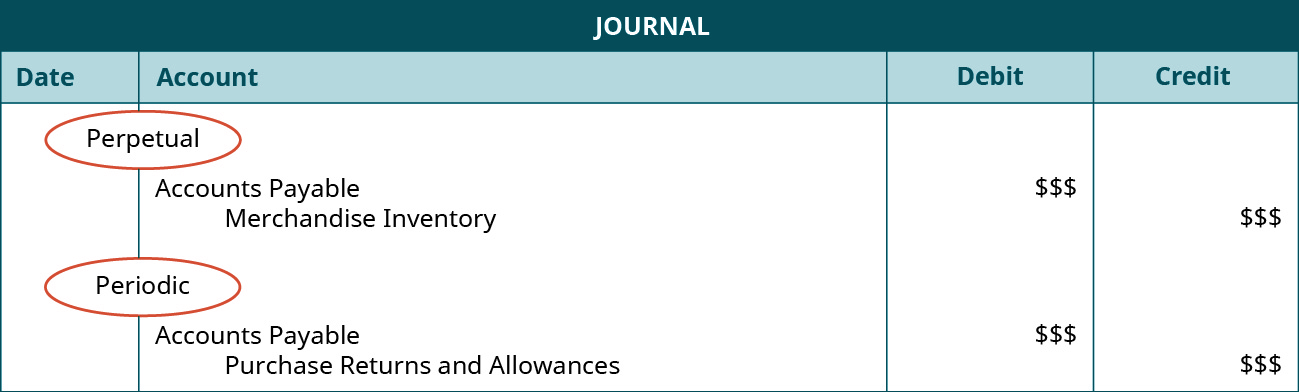

When merchandise purchased using an account are returned to a supplier, it is necessary to debit the accounts payable account and credit the purchase returns and allowances account. Under the perpetual system, the company can make the purchase return journal entry by debiting accounts payable or cash account and crediting inventory account. Returns must be recorded in the same accounting period in which the original purchase was made to ensure that financial statements accurately reflect the company’s financial position. This practice helps in maintaining consistency and reliability in financial reporting.

Presentation of Purchase Returns and Allowances

Instead, it keeps the goods and receives an allowance or a price reduction. However, it affects the company’s purchases figure in its income statement. Usually, companies record purchase allowances in the same account as purchase allowances. To create a purchase return journal entry, you will first need to identify the merchandise that was returned. Next, you will need to record the credit that was given to you by the vendor or supplier. Finally, you will need to subtract the cost of the returned merchandise from your total sales for the period.

FOB Destination means the seller is responsible for paying shipping and the buyer would not need to pay or record anything for shipping. FOB Shipping Point means the buyer is responsible for shipping and must pay and record for shipping. To update your inventory, debit your Inventory account to reflect the increase in assets. And, credit your Cost of Goods Sold account to reflect the decrease in your cost of goods sold.

The buyer may want to know the amount of returns and allowances as the first step in controlling the costs incurred in returning unsatisfactory merchandise or negotiating purchase allowances. For this reason, buyers record purchase returns and allowances in a separate Purchase Returns and Allowances account. Under the periodic system, the company needs to make the purchase return journal entry by debiting accounts payable safe harbor or cash account and crediting purchase returns and allowances account. No, the journal entries are the same whether merchandise is returned for a credit note or for a refund of cash. In both cases, the accounts payable or accounts receivable account is debited, and the purchase returns and allowances account is credited. Purchase returns are goods that a company returns to its suppliers due to various reasons.

The first approach is to record returns and allowances in the general journal, which is appropriate for companies with only a few returns and allowances during the year. The second one is to record these transactions in a special journal known as the sales returns and allowances journal. The second approach is more convenient for companies that experience too many such transactions during the year.

The purchase returns and allowances account is offset against total purchases when calculating the cost of goods sold. Any difference between invoice price and reduced price (i.e., the price that is finally received from the customer) is known as allowance. This allowance should not be confused with the sales discount, which is initially entered in the cash receipts journal at the time of receiving cash from buyers.