No products in the cart.

Kyle Dionne |

Perhaps one of the most common hurdles to own earliest-date home buyers try assembling funding to own a deposit. Its a dependence on really mortgage loans, also it can apply at how much cash possible spend throughout the lifestyle of the home loan. How much you’ll need for a downpayment hinges on certain household purchase facts.

Let’s consider just how off money works, tips determine extent you’ll need, and methods in making their advance payment.

A down-payment is the amount of money you have to pay upfront in order to safer a home buy. Which payment is frequently a share of one’s house’s full pick speed. Homeowners normally take-out a home loan to invest in the essential difference between the price as well as their deposit.

The necessary minimal down-payment have a tendency to mostly believe the kind out-of assets you’re to invest in, cost in addition to type of mortgage you get.

While you are to purchase a proprietor-occupied domestic (whether or not an initial otherwise additional house) with a prime financial, your minimal necessary deposit will depend on price:

When you have a reduced credit history, are notice-working otherwise have lower income, lenders may require increased down-payment to be considered. Home buyers who put lower than 20% down are needed to buy financial standard insurance coverage, and therefore protects the financial institution just in case you can not pay off the home loan.

If you take out a mortgage due to a choice or B bank, you’ll be expected to set at the very least 20% down, whatever the cost. Option mortgages introduce more risk so you can loan providers, therefore consumers need certainly to put more income as a result of balance out one to chance.

A moment household to own sport, relatives and other motives will be funded which have only a great 5% advance payment. Although not, borrowers whom lay 20% or higher upon the acquisition out of the second domestic can be stop investing mortgage default insurance policies.

While the an advance payment from inside the Canada hinges on family rate (among other variables), i don’t have a national mediocre downpayment per se.

Yet not, according to Canadian A property Organization (CREA), the common price point getting a home is $703,446 at the time of . Due to the fact $703,446 falls between $five hundred,000 and you will $999,999, a home customer playing with a primary home loan to finance a buy at this count would need to set out 5% of one’s very first $500,000, and you can spend 10% towards the relax. That means minimal deposit toward mediocre household rates is approximately $45,345 in the event the pick was funded which have a primary financial.

So you can fund a great $703,446 house buy that have a b financial, you’ll need lay out 20%, hence wide variety so you can as much as $140,689.

Their advance payment has a direct impact into home loan amount your borrow, which often impacts just what you can easily spend inside the focus along the lifetime of your home loan.

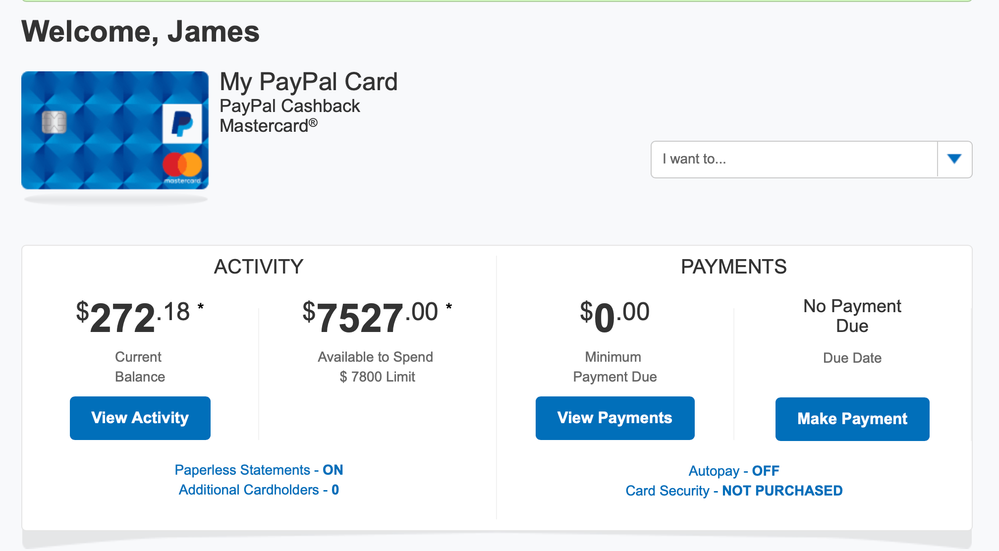

Case in point off how their downpayment impacts their financial can cost you, using a property cost of $five-hundred,000, an interest rate of 5%, a 25-seasons amortization period as well as the mediocre Canada Home loan and you will Housing Enterprise (CMHC) advanced costs. The info less than takes on upfront fee of the entire financial standard premium. Borrowers who move their superior in their home loan pays desire for the more matter, that can enhance their full mortgage will cost you. Including note that the desk less than does not take into account prospective home loan settlement costs.

As you can tell, the fresh borrower just who puts off 20% notably lowers the 1st financial amount. They’re going to as well as cut thousands off bucks on a lot of time-run by paying desire on the a smaller sized financial, and also by to avoid home loan standard insurance policies.

A deposit is intended to come out of a home consumer’s very own money to show they can personal loans online Washington spend the money for mortgage they are using up. Here are some tips getting protecting within the down-payment count you will need.

- Create a monthly funds. You may find you might kepted more funds for many who prioritize extremely important purchasing and scale back on a whole lot more deluxe expenses. Carrying out yet another month-to-month finances can also help prepare yourself your getting the payment when the and if you have made a mortgage.

- Unlock a downpayment bank account. Independent your own personal deals out of your down payment discounts by the opening another account. You could potentially set up automatic dumps to make sure cash is always entering the account. You could also discover an income tax-100 % free checking account (TFSA) and you may dedicate to own possibly significantly more offers.

- Pay down the money you owe. Paying off the other an excellent expenses such as for example credit debt, auto loans otherwise student loans can release funds flow getting lay into the a deposit. Repaying such costs also can improve your credit rating and you may financial obligation service proportion (DSR), which will help you secure top home loan costs.

Whenever you are fortunate enough to get funds from an immediate relatives affiliate a father, grandparent, sibling otherwise child to support their downpayment, you’ll need to offer their lender with a gift page.

Homebuyers unable to save up having a down-payment get be eligible for certain Canadian down payment advice apps. Current programs in the Canada become:

Home Buyers’ Bundle (HBP)

Brand new HBP lets home buyers which have Entered Retirement Savings Agreements (RRSPs) in order to withdraw around $60,000 using their RRSP membership to get to the an advance payment. Consumers can also be discover one to count taxation-100 % free whenever they pay it off within this 15 years.

Earliest House Savings account (FHSA)

First-time home buyers who happen to be Canadian people involving the chronilogical age of 18 and you may 71 can be unlock an enthusiastic FHSA and you will conserve so you can $40,000 to place towards an advance payment. This type of finance try nontaxable.

GST/HST The newest Casing Rebate

Being qualified home buyers can be discovered a taxation discount off their goods and services taxation (GST) and matched up conversion process tax (HST) to put into a downpayment. You don’t need to be a primary-date home client to meet the requirements. Yet not, new rebate is usable on freshly constructed otherwise renovated domestic requests.

The bottom line

A deposit obtains your house purchase and you will home loan, while the number you put off has an effect on the entire price of credit. If you find yourself a much bigger down-payment are a pricey upfront pricing, you could potentially spend less fundamentally, particularly if you lay 20% or maybe more down.