No products in the cart.

Drawbacks from assumable mortgage loans:

- To own People: You need to nevertheless get the borrowed funds and satisfy their needs, limiting your choice of lenders. You don’t Aleneva loans need the luxurious of doing your research getting a lender because you will need to be acknowledged to own, or take towards the terms of the current financial.

- To possess Customers: As previously mentioned earlier, in case the supplier have big household security, you will probably need make the bucks to own a critical down-payment, and this can be an economic difficulty.

- To possess People: In the event the a supplier is aware of brand new desirability of its house of the assumable financial, this could improve interest in our home and enable these to increase the purchase price, deciding to make the offer procedure much more competitive. Since a purchaser, we should be mindful to not overpay to your household on the best function of inheriting the mortgage. Its best if you calculate the brand new monthly payments having all land it comes to to see the way they contrast.

Type of Assumable Mortgages

To imagine an enthusiastic FHA loan, you must meet the practical FHA financing requirements, that may become making at least down payment regarding step three.5 per cent and achieving a credit rating of at least 580.

It’s important to observe that conventional funds are usually maybe not assumable, but when you look at the particular circumstances, such as shortly after passing or breakup.

How to Assume home financing

Before incase home financing, you must receive approval from the original bank. So it normally involves conference an equivalent criteria due to the fact acquiring a routine home loan, such as for example a being qualified credit score and a reduced personal debt-to-earnings ratio. Here are the general tips to adhere to:

- Show Assumability: Be certain that whether the loan is actually assumable and you will consult with the modern home loan holder’s lender to ensure they permit assumption. You could earliest want to get in contact with the vendor being have the contact info on modern lender.

- Get ready for Will set you back: Find out the remaining harmony on the home loan so that you will perform brand new mathematics to your cash just be sure to bring to closing. If you believe the remainder harmony requires additional capital, begin shopping around having lenders that may give can discover brand new terminology (note that this can are very different towards latest interest levels, and they could be faster good words compared to home loan you is actually while)

- Submit an application: Submit an application, bring called for forms, and you can fill out identity. The particular techniques may vary with respect to the financial.

- Close and you can Signal Release of Liability: While the assumption of one’s financial might have been accepted, you may be addressing the last phase of one’s procedure. Like closing other home loan, you’ll need to finish the called for paperwork to ensure a mellow change. One to extremely important file that frequently will be ‘s the release regarding liability, which provides to confirm the merchant has stopped being in charge into financial.

In this phase, it’s vital to absorb the facts of one’s discharge of responsibility. Make sure that most of the necessary data was correctly reported, including the labels and contact details of both parties, the property target, the mortgage facts, and any other relevant recommendations. Examining the fresh new file properly can help minimize the risk of any dilemma otherwise judge difficulties afterwards.

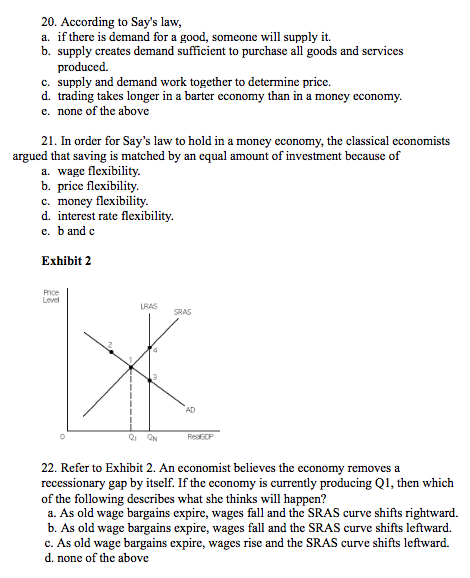

Consider, the fresh new signing of launch of accountability is short for a significant changeover for the buyer therefore the vendor. It scratching when if torch is actually introduced, while the consumer assumes on full duty toward financial. From the finishing this step faithfully and you can thoughtfully, you possibly can make a good base having a successful and you can lawfully joining assumable financial contract.